Can We Build Together at Scale? A Co-Op Capital Vision

This week, I gave a presentation to a group of Cooperative Business leaders (3 largest U.S. co-op banks (NCB, CoBank and CFC), 5 co-op capital entrepreneurs, 6 co-op loan fund/CDFIs, 2 mutual insurance cos., and 6 associations). My question was:

Can we imagine and build together — across credit unions, electric co-ops and emerging co-op innovators?

What’s exciting to me about this gathering is that NCBA CLUSA and NCB have convened the group along with Principle 6 (co-ops helping co-ops) organizers Mike Mercer and Diana Houston.

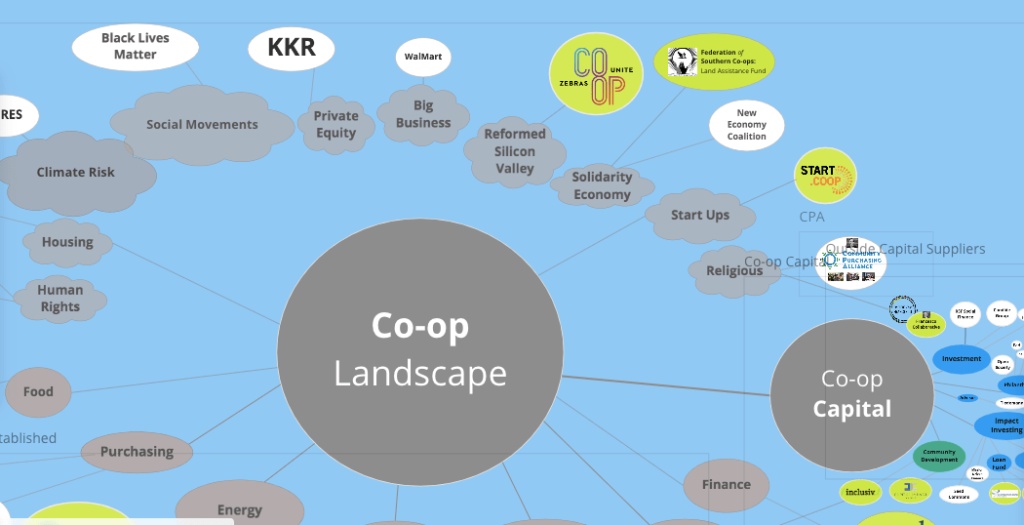

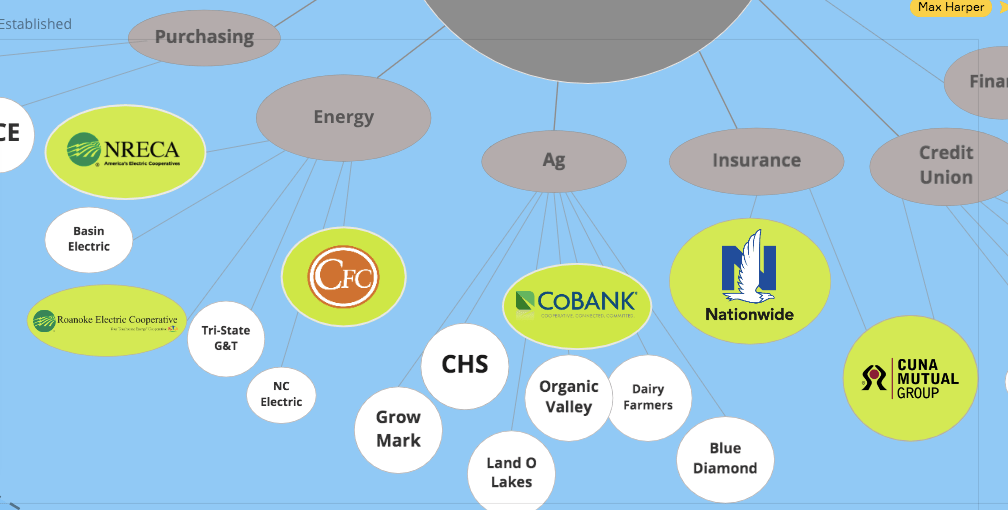

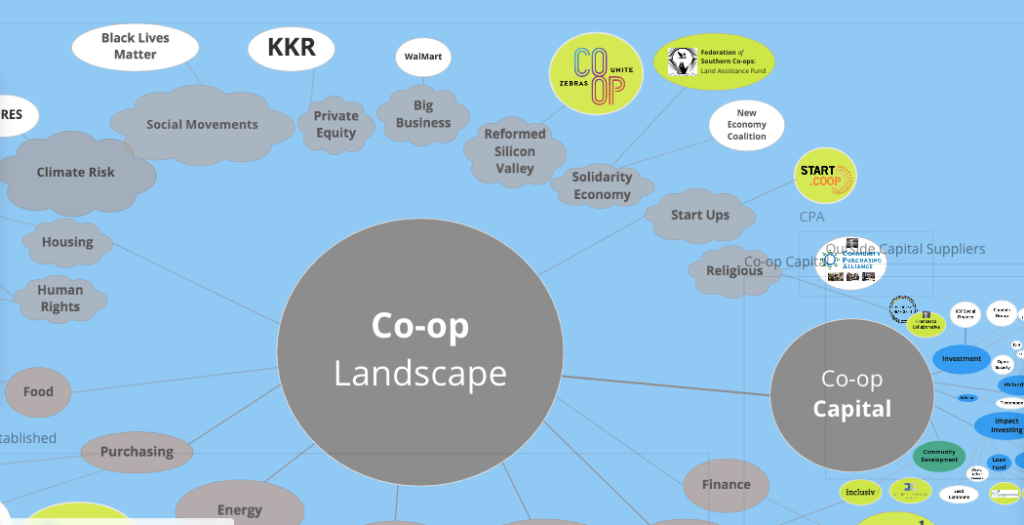

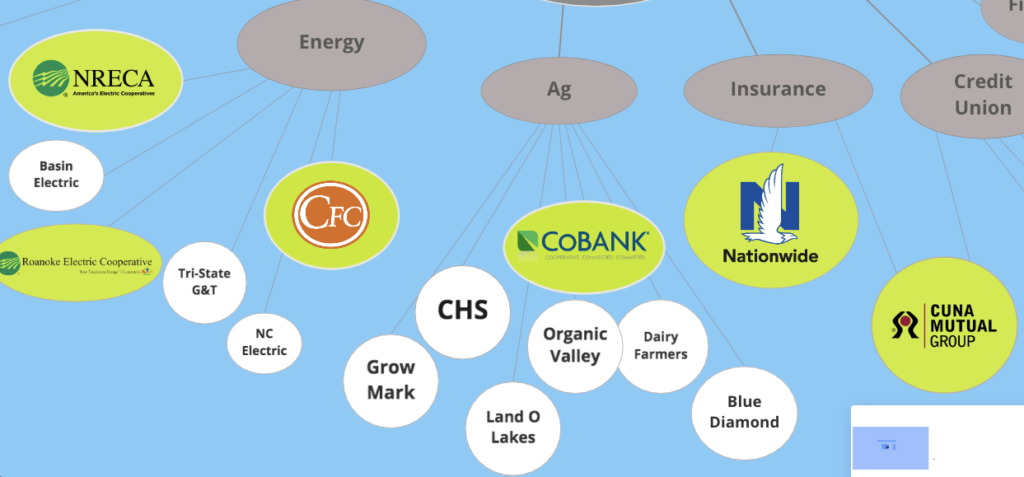

They’ve gathered representatives from across the most established co-op business sectors:

As well as representatives from the emerging co-op ecosystem (the cloud shapes):

Before we dive into this landscape picture, let me tell you a bit about how I came into this conversation and why I feel particularly motivated.

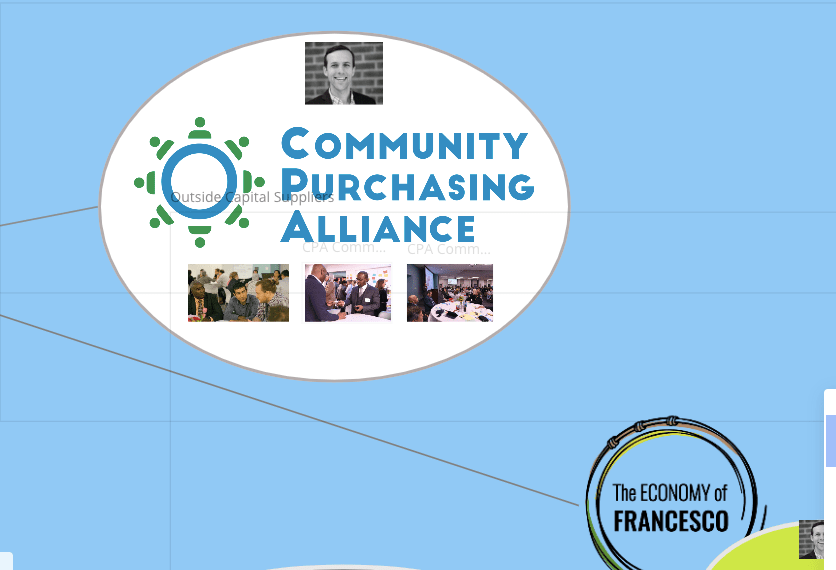

In trying to grow CPA, I found it hard to find the right Capital Partners.

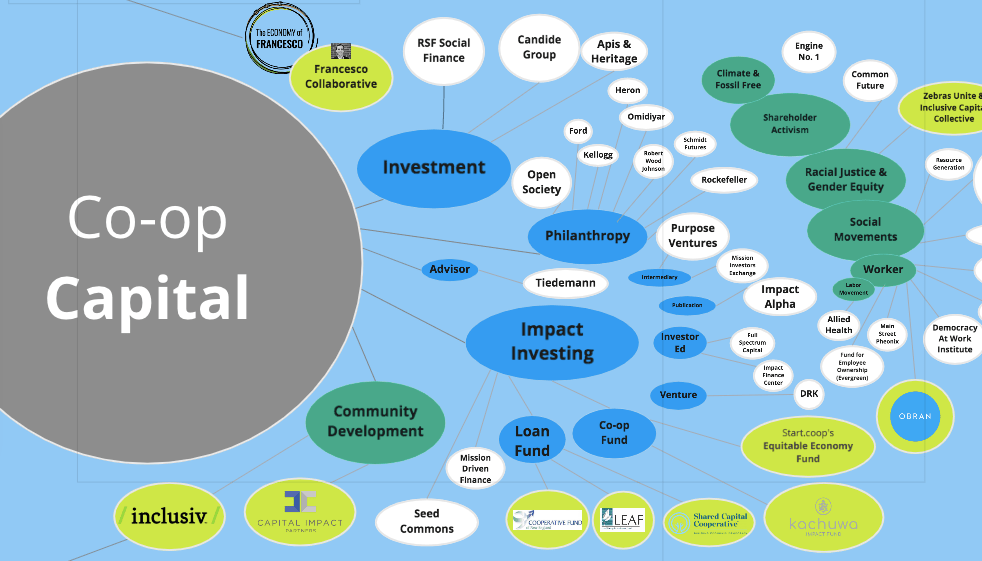

I spent 10 years building the Community Purchasing Alliance (CPA) Co-op. We’ve gotten to $20 million / year in recurring facility contracts for about 150 churches, synagogues and schools. And $1 million in annual revenue and 5 years of profits. As I’ve been looking to grow CPA to Ohio, Illinois, North Carolina, New England — I found it easy to raise $100-200k in a line of credit or small investment, but I’ve been looking for more significant capital partners to grow to 5-10 places. This fundraising has taken me on a journey to philanthropy, venture investing, impact investing, CDFIs — but I haven’t found a good fit. In the process I’ve built a map of the current co-op capital ecosystem:

I’ve left CPA Co-op because I think we need to build the entities that can be better capital partners for growth-focused co-op businesses.

What I’ve learned is that outside suppliers of capital are showing significant interest in co-op (and other alternative) business structures.

The question for us — as leaders in the co-op business movement — Can we raise some meaningful capital from within the co-op sector?

Do we believe in our own model?

Do we believe we have a strategic advantage in delivering sustained community / social impact in part because of our co-op business structure?

Here’s why I believe interest in co-ops (and other alternative biz structures) will grow over the next couple decades:

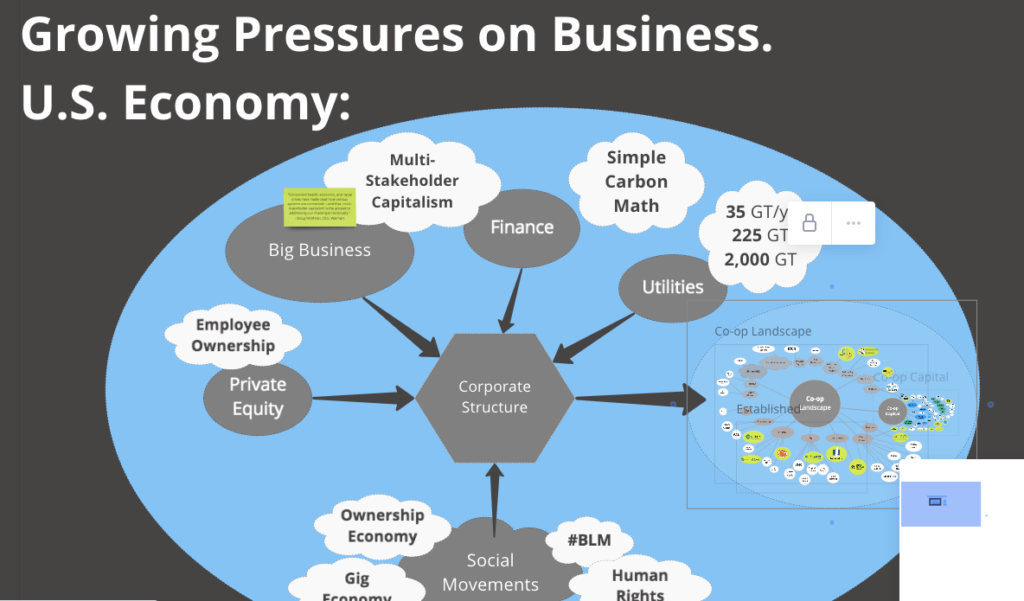

There’s significant and growing pressure on conventional business to deal with social, environmental, racial, health crises.

Simple carbon math.

- 2 degrees C.

- 35 GT / year (current global emissions).

- 225 GT – our remaining carbon Budget before we get to 2 degrees C and runaway climate change, feedback loops.

- 2,600+ GT — the amount of carbon that ExxonMobil and the other major oil & gas companies plan to produce. It’s the Proven Reserves that they have that make up a meaningful portion of their “market capitalization” which is the valuation that our stock ownership in them is based on… It also shows how our current markets (and the growth of our current investments) continues to create an increasingly unlivable future… unless we decide to change.

The Business Roundtable is re-defining the “purpose of a corporation.”

“Concurrent health, economic, and racial crises have made clear how various systems are connected — and that multi-stakeholder capitalism is the answer to addressing our challenges holistically.”

Doug McMillion, CEO of Walmart

When Doug McMillion CEO of Walmart and chair of the Business Roundtable says — multi-stakeholder capitalism is the answer. To me, this signals the importance of customers, suppliers, employees — other stakeholders that aren’t currently represented in governance and ownership of big business in the U.S. Economy.

Private equity pushing for employee ownership

Employee ownership being championed by Pete Stavros from KKR – signalling the awareness that productivity of manufacturing isn’t increasing with the current model. Pete is investing $20 million of his own money for a new center on employee ownership — showing his personal conviction that different ownership structure is needed.

Social Movements shaping our culture

Social movements — Black Lives Matter — and others — are shaping the culture that surrounds us in business and this too is putting pressure on the conventional understanding of business and it’s purpose.

All of this to me points to the need to look to alternative business structures.

Who has an alternative governance and ownership structures working at large scale?

Who doesn’t center capital’s interest’s but instead focuses on producers or customers as their primary stakeholder?

Who has an alternative that works across multiple industries at scale?

I believe as more look deeper into these questions, they will increasingly find their way to co-ops.

The question for us (as co-op business leaders) is — do we have an ecosystem of organizations to welcome them in and show them how they can convert their businesses to co-ops?

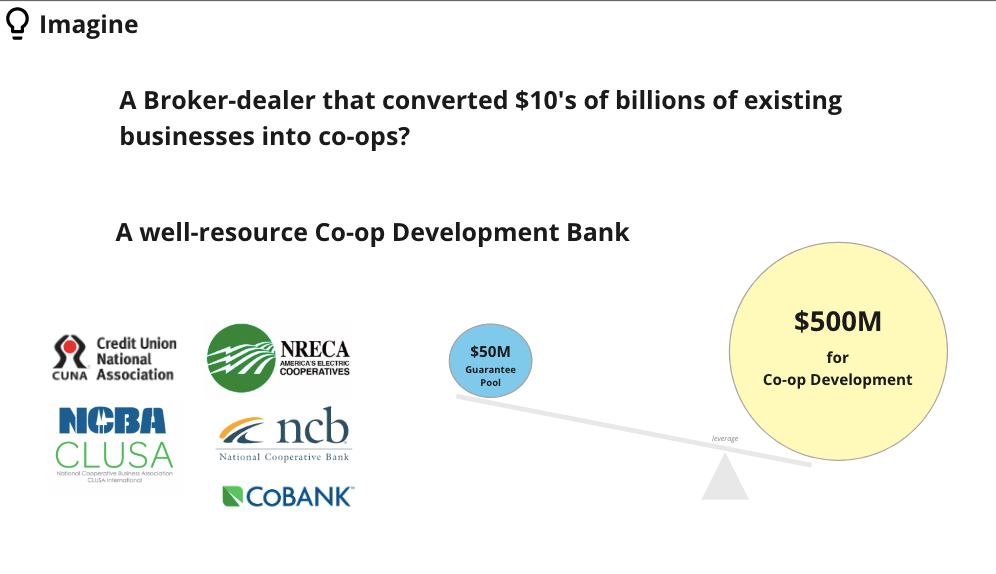

Do we have investment banks and co-op development banks at the ready with capital to deploy and support existing business and growth focused businesses to choose the co-op model?

Could you imagine something like this?

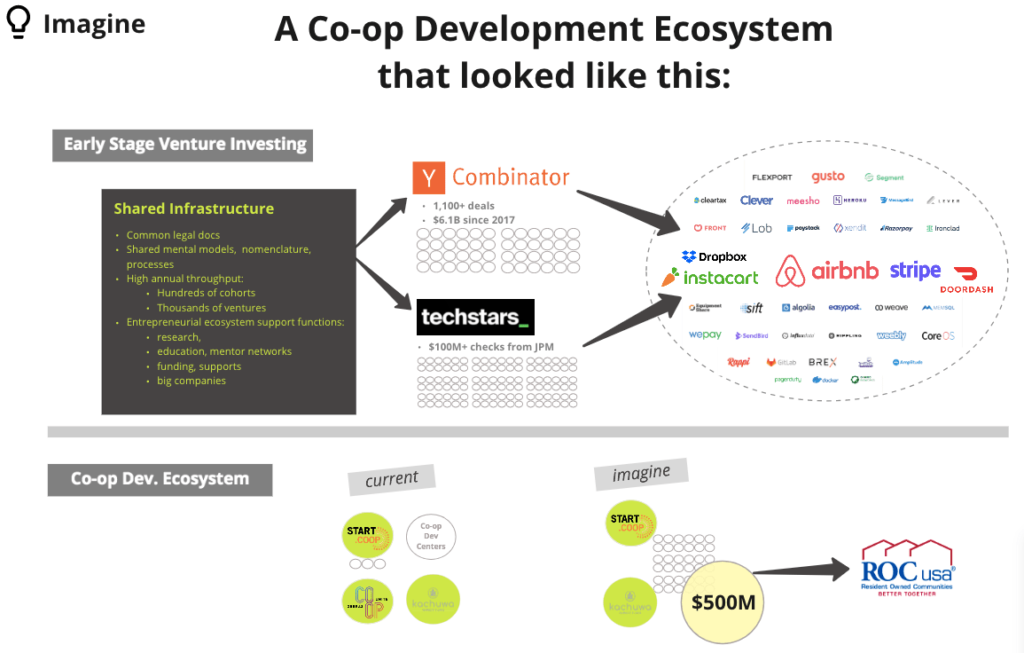

I think the co-op development ecosystem today looks like the seed stage venture investing ecosystem did 15-20 years ago.

Could we imagine growth in our co-op development ecosystem to match the venture investing space today — that’s produced major folks like AirBnb, DropBox, Instacart — could we imagine co-ops with that kind of stature?

I believe I can only imagine and dream of these types of futures — because you (the established co-op leaders) are here in the room.

As a representative from the emerging co-op landscape, I realize that what we lack is what you have. (You as the established co-op sector).

- Your $4 Trillion in assets — credit unions / CUNA

- Your 50 million customers — NRECA

Your presence affords me the opportunity to think and dream and imagine at scale.

The question is:

Can we translate this into action at scale?

I believe the only way to make progress towards these visions is if those who haven’t been part of these conversations — these principle 6 (co-ops helping co-ops) conversations — go back to their teams and internalize ownership for this current opportunity — and the moment we’re in.

If we began to act on building something together…

- Shared infrastructure

- Shared national cooperative brand

- Shared pools of capital

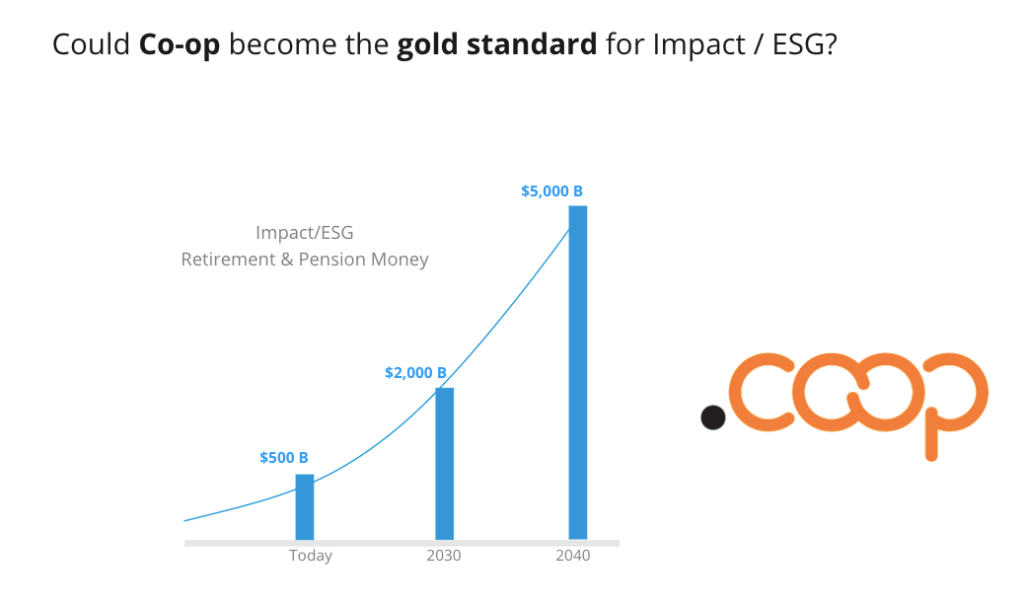

I think we could re-define impact / ESG investing.

Co-ops are structurally different.

Could we become the gold standard in impact investing?

Felipe Witchger co-founded the Francesco Collaborative to build the strategic capacity of the cooperative and employee ownership movements.

Category: Blog Posts